This is the time of year when students and their parents pack a light lunch or an overnight bag and head off to visit colleges. Some may be aware that these highly orchestrated guided tours are marketing tools. After all, colleges are in a high-stakes competition with one another to attract students and money. That’s capitalism. Families later receive a second big marketing job: the financial aid letter. Unfortunately it hides more than it reveals.

Specifically, it obscures the real cost of going to college and the means of paying for it. Colleges, in which we put so much trust, knowingly draft confusing and deceptive financial aid letters to make their value look better than it actually is.

According to Mark Kantrowitz, a financial aid consultant with Edvisors.com, the letters “are designed to convince the family that the college costs less and is more affordable than it really is.”

So where does the deception come in? It’s mainly with student loans. Most colleges conceal loans next to grants and scholarships. But loans have to be paid back and should never be mixed with aid that is free.

The greatest omission is not providing loan terms. If you buy a house or a car, the law requires that you receive loan information. But colleges and universities and their lobby down in Washington press to retain their complete discretion over how they draft their letters – and that means they are not legally required to disclose their terms. Colleges and universities have become one of the most effective lobbies in Washington, employing more lobbyists last year than any other industries except drug manufacturing and technology. They have teeth!

The reasoning of the lobby is simple: Complete knowledge of loans would scare off students.

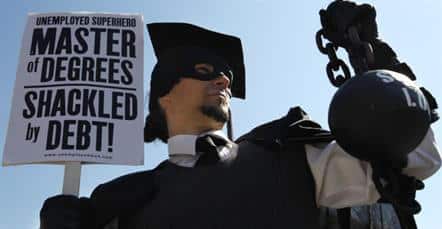

The lobby is correct. If students knew the real costs of the loans, they would scare.

The letters show only one year of borrowing, when almost all students must borrow for four. The letters make no mention of interest, which starts to accrue the moment a student walks into college and accumulates to be as much as the principal in many cases. The letters are blind to the fact that severe penalties are placed on anyone who falls behind or defaults on these loans.

If they had this information, students might select a cheaper school requiring fewer loans, maybe a public over a private school.

Where does the U.S. Department of Education stand in all of this? The department knows that these deceptive practices are widespread. To eliminate any wiggle room for deception, in 2012 it introduced a simple and effective sample financial aid letter, called the Financial Aid Shopping Sheet. This sample letter is a voluntary standard recommended to colleges by the federal government. It clearly identifies the total cost of attendance, specifies the amount of financial aid in the form of grants and scholarships in a separate section from loans and work-study and shows the true net cost to families.

Nevertheless, fewer than half of colleges now use it. And many that do use it do so only for veterans, a sign of just how much many colleges resist real change. The Washington Post reportsthat “The colleges with the most egregious practices have so far refused to adopt the Financial Aid Shopping Sheet and are unlikely to do so until it is required by law.”

If we are serious about making college affordable again and reducing the student loan debt, we must change the college financial aid letter.

http://learninglab.wbur.org/2016/01/15/guest-commentary-beware-the-college-financial-aid-letter/